trust capital gains tax rate australia

Minimizing capital gains on crypto. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits on the sale of a home.

Business Setup Chartered Accountant Internal Audit Accounting Services

The first one is main residence exemption.

. Corporate taxation Rates Corporate income tax rate 30 standard rate25 Branch tax rate 3025 Capital gains tax rate 3025 capital gains are included in. What is capital gains tax. The medicare-exclusive tax rate includes a Temporary Budget Repair Levy of 2 in the 3 years from 1 July 2014 until 30 June 2017From 1 July 2017 the rate reverts to 45.

Janes estimated capital gains tax on her crypto asset sale is 1625. Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the. See Sec 98 and also Taxation of trust net income for non-resident beneficiaries 1 The general individual resident tax scales are here however see also Tax on minors 5 2 The general individual.

Pty Ltd partnership corporate limited partnership trust superannuation fund sole trader and branch of a foreign company. The capital gain or loss is generally taken into account in the trusts net capital. Your capital gains are offset by your capital losses.

Capital gains tax CGT in the context of the Australian taxation system is a tax applied to the capital gain made on the disposal of any asset with a number of specific exemptions the most significant one being the family homeRollover provisions apply to some disposals one of the most significant of which are transfers to beneficiaries on death so that the CGT is not a quasi. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. Sell off losing investments.

Angola Last reviewed 19 July 2022 Capital gains arising from the disposal of financial. These costs could include trading fees withdrawal fees and any other costs incurred when purchasing or trading crypto. Avoiding Capital Gains Tax.

Australia collects capital gains tax only upon realized capital gains. For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0. Short-term capital gain tax applicable on this type of asset is calculated as per the slab rate applicable to the non-resident.

Capital Gains Tax Exemptions or Discounts. International Tax Australia Highlights 2022. The general capital gains tax rate in Colombia is 10 with the exception of lottery or gambling winnings which are taxed at 20.

Headline corporate capital gains tax rate Headline individual capital gains tax rate Albania Last reviewed 21 June 2022 15. However if the asset is owned by a company the company is not entitled to any CGT discount and youll pay a 30 tax on any net capital gains. Short-term capital gains tax on other assets The securities other than debt mutual funds and shares of an Indian company that are sold in less than 24 months qualify as short-term capital asset.

Many people qualify for a 0 tax rate. The 1012 Tax Bracket. List of CGT assets and exemptions Check if your assets are subject to CGT exempt or pre.

The annual individual and special trust exemption is R40 000. There are several ways in which you can avoid capital gains tax. It is important to note that a company which is a trustee of a trust is not subject to company tax on the trust income it has responsibility for administering.

The rates are much less onerous. Fortunately when you inherit real estate the propertys tax basis is stepped up which means the value is re-adjusted to its current market value and often reduces or entirely eliminates the capital gains tax owed by the beneficiaryFor example Sallys parents purchased a house years ago for 100000 and bequeathed the property to Sally. While this re-characterization of capital gain to ordinary income under IRC section 751 changes the rate of taxation for federal tax purposes it does not require a bifurcation of the sale into two separate transactions nor does it necessitate a recasting of nonbusiness income into business income.

Algeria Last reviewed 01 June 2022 Capital gains are subject to the normal CIT rate. CGT event is the date you sell or dispose of an asset. The rates are much less.

Main residence exemption allows homeowners to avoid paying capital gains tax if their property is their principal place of residence PPOR. What is a Capital Gains Tax event. And for an SMSF the tax rate is 15 and the discount is 333 rather than 50 for individuals.

Capital gains tax is a tax you pay to the government when you make a profit by selling your investment property or something else of value for more than you originally paid for it. Disposal of a trust asset or another capital gains tax event is likely to result in a capital gain or loss for the trust unless a beneficiary is absolutely entitled to the asset. For example if you spent 310000 on buying a house years ago and sold it for 500000 today then your capital gains would be 190000 and youd have to.

Long-term capital gains tax rates typically apply if you owned the asset for more than a year. In relation to capital gains tax CGT a trust which holds an asset for at least 12 months is generally eligible for the 50 capital gains tax concession on capital gains that are made. If you have some investments that have decreased in value since you bought them selling them would reduce your total capital gains.

How to calculate capital gains tax CGT on your assets assets that are affected and the CGT discount. For individuals is payable and for corporate taxpayers a maximum of 224. For example suppose you own some stock that you purchased for 50000.

Its important to keep all your receipts for costs related to purchases of capital gains assets.

How To Buy Cryptocurrency In Australia Buy Cryptocurrency Cryptocurrency How To Become Rich

Introduction To Law Law School Wellesley Career Education Law School School Application Law School Application

Design A Modern Professional Logo For Taxteam By Lesung Pipi Personal Logo Design Circle Logo Design Logo Design Feminine

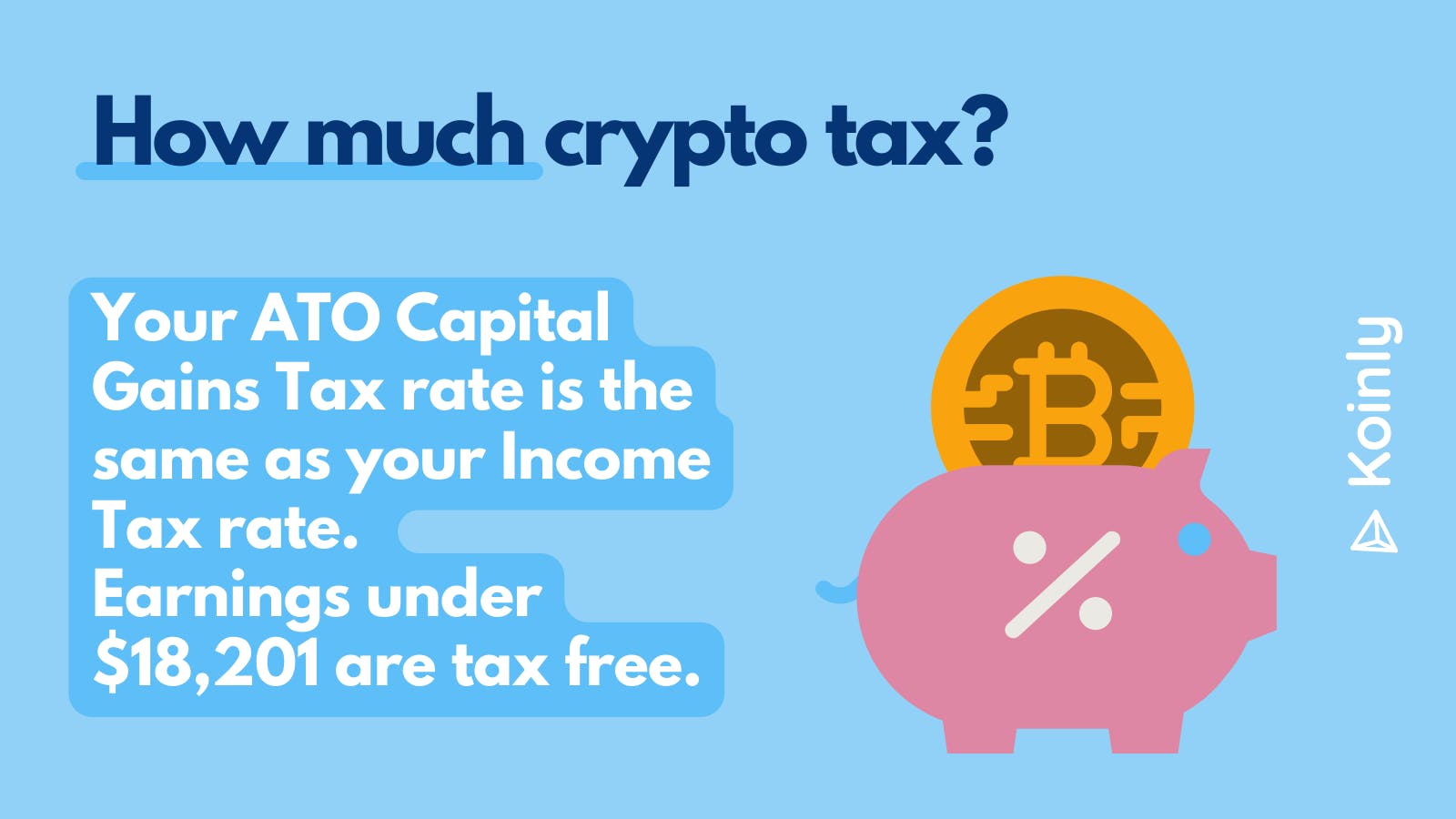

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Dream Logo Design Dreamlogodesign Twitter Goods And Service Tax Goods And Services Accounting Services

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Pin On Economies And Governments

Capital Gains Tax Cgt Calculator For Australian Investors

Http Accountantsbrighton Blogspot In 2014 08 Capital Gains Tax Mitigation Tax Html Starting A Business Accounting Certified Accountant

Challenges That Today S Accounting Firms In Melbourne Face Accounting Firms Accounting Small Business Bookkeeping

Capital Gains Tax Cgt Calculator For Australian Investors

Buy Gold Online Buy Gold Online Buying Gold Buy Gold And Silver

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Travel With The Best Rates In Town Melbourne Lkr 54 100 Onwards Call Student Hotline 0766399900 Travel Melbourne Student Travel September Travel Student

Accounting Chart Shows Balancing The Books And Accountant Stock Illustration Stock Illustration Royalty Free Illustrations Accounting Accounting Books Photo

Capital Gains Tax Cgt Calculator For Australian Investors

Import Duties Goods Subject To Antidumping Or Counterveiling Customs Duties Duties Custom

Why You Should Consider Investing In Precious Metals Tax Twerk Gold Price Gold Gold Investments

Modern Professional Looking Logo For An Accounting Business By Graphicsdreams Personal Logo Design Logo Design Business Logo